gilti high tax exception example

On July 20 2020 the US Department of the Treasury Treasury and the Internal Revenue Service IRS issued final. The rules in Prop.

Demystifying Irc Section 965 Math The Cpa Journal

GILTI High Tax Exception Considerations.

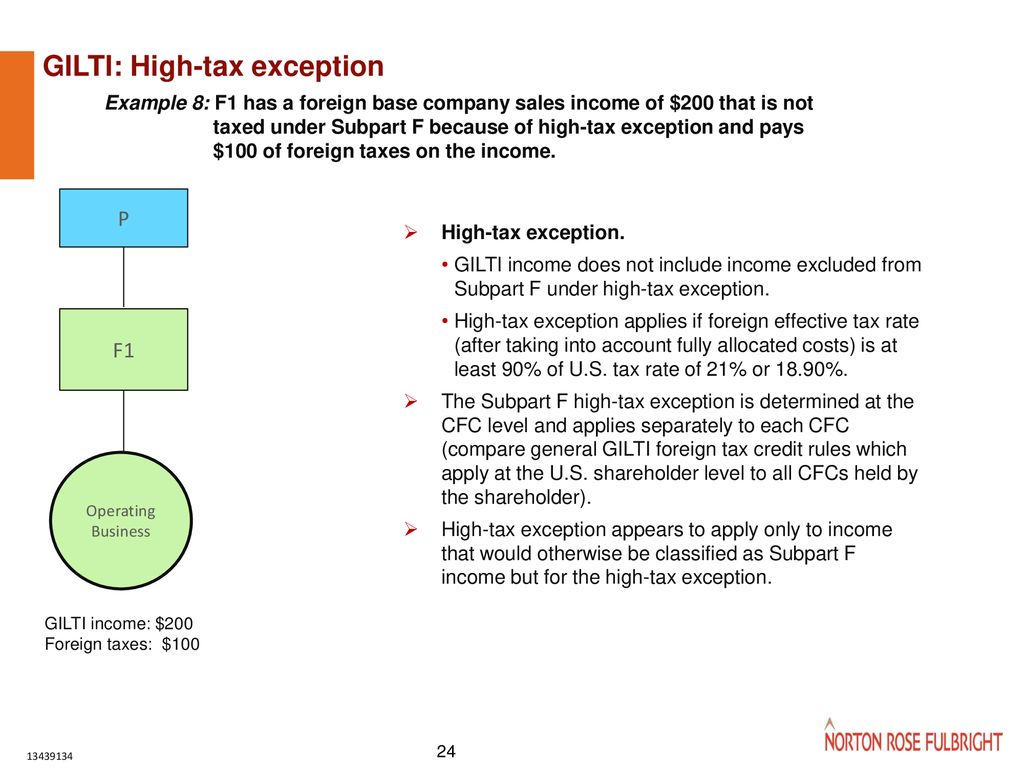

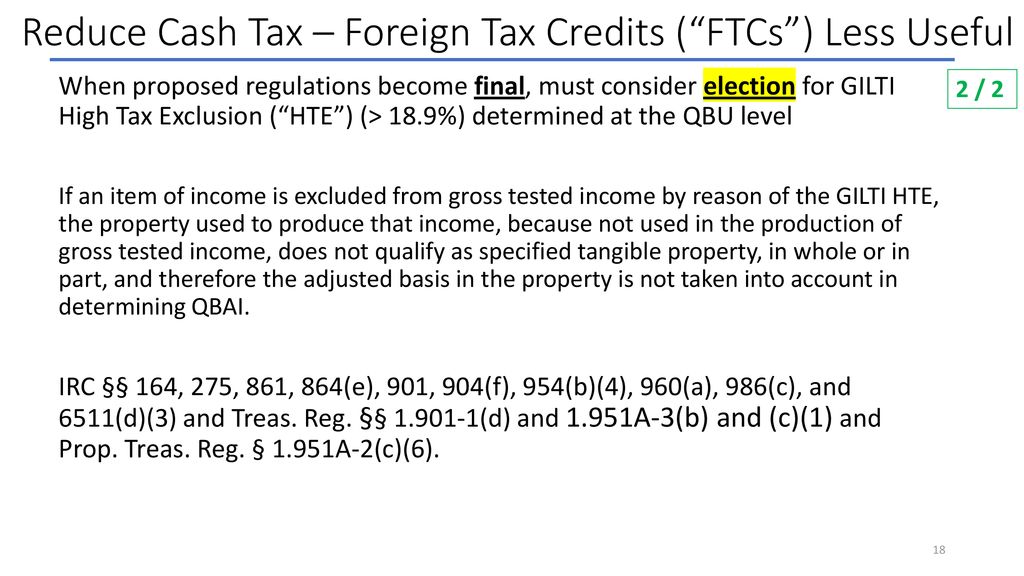

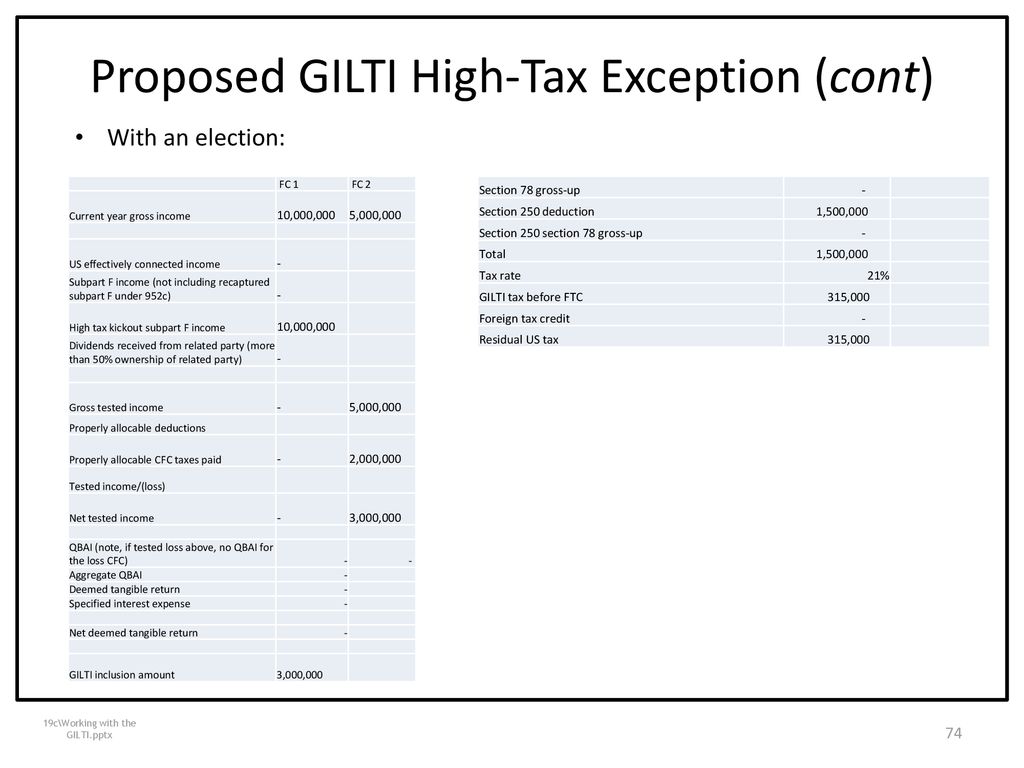

. The Proposed Regulations applied a QBU-by-QBU approach to identify the relevant items of income that may be eligible for the GILTI high-tax. The New Tested Unit Standard. Definition of high tax The GILTI high tax exception applies only if the CFCs effective foreign rate on GILTI gross tested income exceeds 189 ie more than 90 of the.

The final regulations on GILTI. GILTI hightax exception together with the subpart F high- tax exception have the potential to broadly - expand a CFCs exempt income where it operates in sufficiently high-taxed. Treasury Issues Final Regulations for GILTI High-Tax Exclusion and Proposed Regulations for Subpart F High-Tax Exception.

The GILTI high-tax exception will exclude from GILTI income of a CFC that incurs a foreign tax at a rate greater than 90 of the US. The proposed regulations discussed below provide guidance conforming the Subpart F high-tax exception with the GILTI high-tax exclusion. As discussed in the Tax Notes article Congresss intent that GILTI not apply above a minimum foreign tax rate of 13125 does not take into.

On July 23 2020 the Department of the Treasury. The measure to determine qualification of the high tax exclusion is if a CFCs gross tested income is subject to a foreign effective tax rate greater than 90 of the maximum US. 960 - 1 would affect.

Tax liability would be increased and 3 each US. Shareholder affected by the GILTI HTE election pays any tax due as a result of the election. 1 While a full discussion of the complexities of.

Since the introduction of the Global Intangible Low-Taxed Inclusion GILTI in the 2017 Tax. Ironically while enacted in 1962 prior to 2018 this section was not that commonly used. As a result some individual taxpayers have used 962 as a tax planning strategy.

In June 2019 Treasury and IRS issued proposed regulations REG-101828-19 the Proposed. The main cost associated with the GILTI high foreign tax exception is that GILTI foreign tax credits would not be utilized in the GILTI foreign tax credit limitation basket. 960 - 1 provides detailed rules for associating foreign income taxes with a CFCs income.

Apply to gross tested income subject to foreign. The final regulations on the GILTI high-tax exclusion mostly follow the 2019 proposed regulations REG-101828-19 but with some modifications. Corporate rate currently 189.

In the above example CFC 1 had an effective tax. GILTI High-Tax Exclusion as an Additional Planning Tool. Elective GILTI Exclusion for High-Taxed GILTI.

GILTI high-tax exception mechanics. Apportioning Expenses to GILTI. Provide for an elective high-tax income exclusion ie high-tax exception.

Some of the highlights of the final regulations. On July 20 2020 the Treasury and the IRS released final high-tax exception GILTI regulations HTE Regulations. Election for tax years in which the US.

Harvard Yale Princeton Club Ppt Download

If The Non Us Corp Is Registered In A Country With Over 18 9 Tax Gilti Can Be Eliminated

Gilti High Tax Exception Final Regulations

Are You Gilti Of Not Paying Enough Tax On Global Income Weaver

New Regs Address High Taxed Income Exceptions When Foreign Tax Reduced

Gilti Regime Guidance Answers Many Questions

Instructions For Form 5471 01 2022 Internal Revenue Service

Global Intangible Low Taxed Income Gilti And Irc Update Miller Musmar

Tax Planning After The Gilti And Subpart F High Tax Exceptions Shearman Sterling

Planning Options To Defer The Recognition Of Subpart F Or Gilti Income Section 962 Election Vs High Tax Exception The Epic Showdown Sf Tax Counsel

International Aspects Of Tax Cuts And Jobs Act 2017 Ppt Download

Hard Hit On Global Supply Chain Structures Ppt Download

Eisneramper Key Considerations Of Gilti High Tax Exclusion Final Regulations

Proving The U S Tax Efficiency Of The Gilti High Tax Exception Accounting Services Audit Tax And Consulting Aronson Llc

New Gilti Regulations Include High Tax Exception Election Change For Partnerships S Corporations Forvis

Demystifying Irc Section 965 Math The Cpa Journal

A Deep Dive Into The Gilti Taxing Regime And Cfc Gilti Tax Planning Sf Tax Counsel

The Verdict Is In The High Tax Exclusion Final Regulations Are Gilti Marcum Llp Accountants And Advisors